Design and 幸运体彩飞行艇168开奖官方直播-幸运飞行艇开奖记录官网查询历史-飞艇168开奖查询网 prototyping tool for web and mobile apps

All-in-one UI / UX design platform to create UI assets, prototypes and simulations

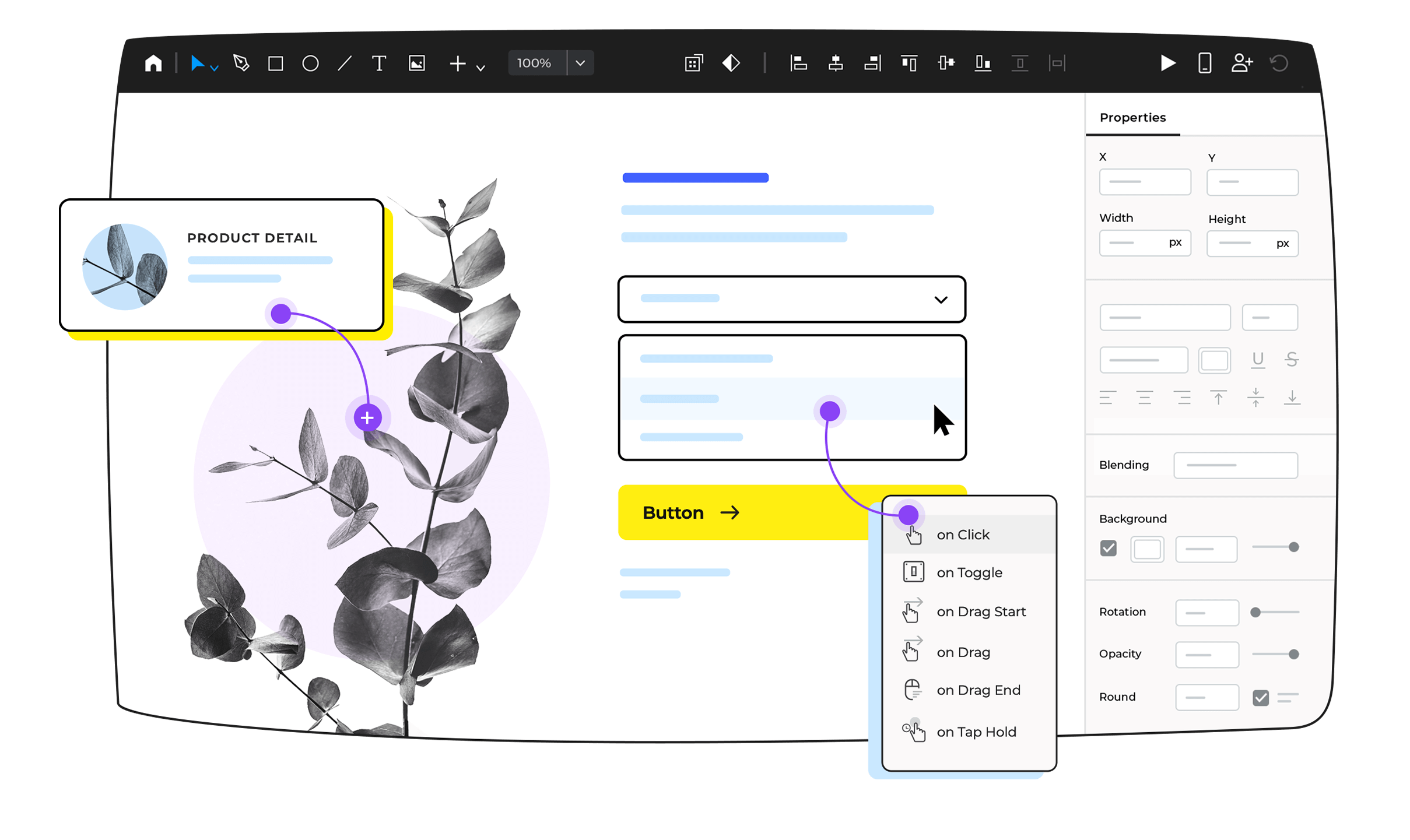

From clickable prototypes to functional simulations

Create from clickable prototypes to fully-functional simulations, without typing a single line of code. We provide a full range of tools, so that you can focus on creating delightful user experiences. Testing through simulations will reduce rework and boost user adoption.

Bring your 168幸运飞行艇开奖官网-168查询官方开奖直播-幸运飞行艇开奖查询记录结果历史 interaction design to a superior level

Design full interactions of your web and mobile products, from the navigation to the last details of the user experience: advanced interactions, animations, transitions, interactive UI elements. Launch easy to use products and boost user adoption.

Design web experiences with a full range of interactions, animations and transitions. Create anything from simple links to advanced interactions.

Choose from a ton of gestures that allow you to rotate, tap, swipe, scroll and pinch your way through your mobile app prototype.

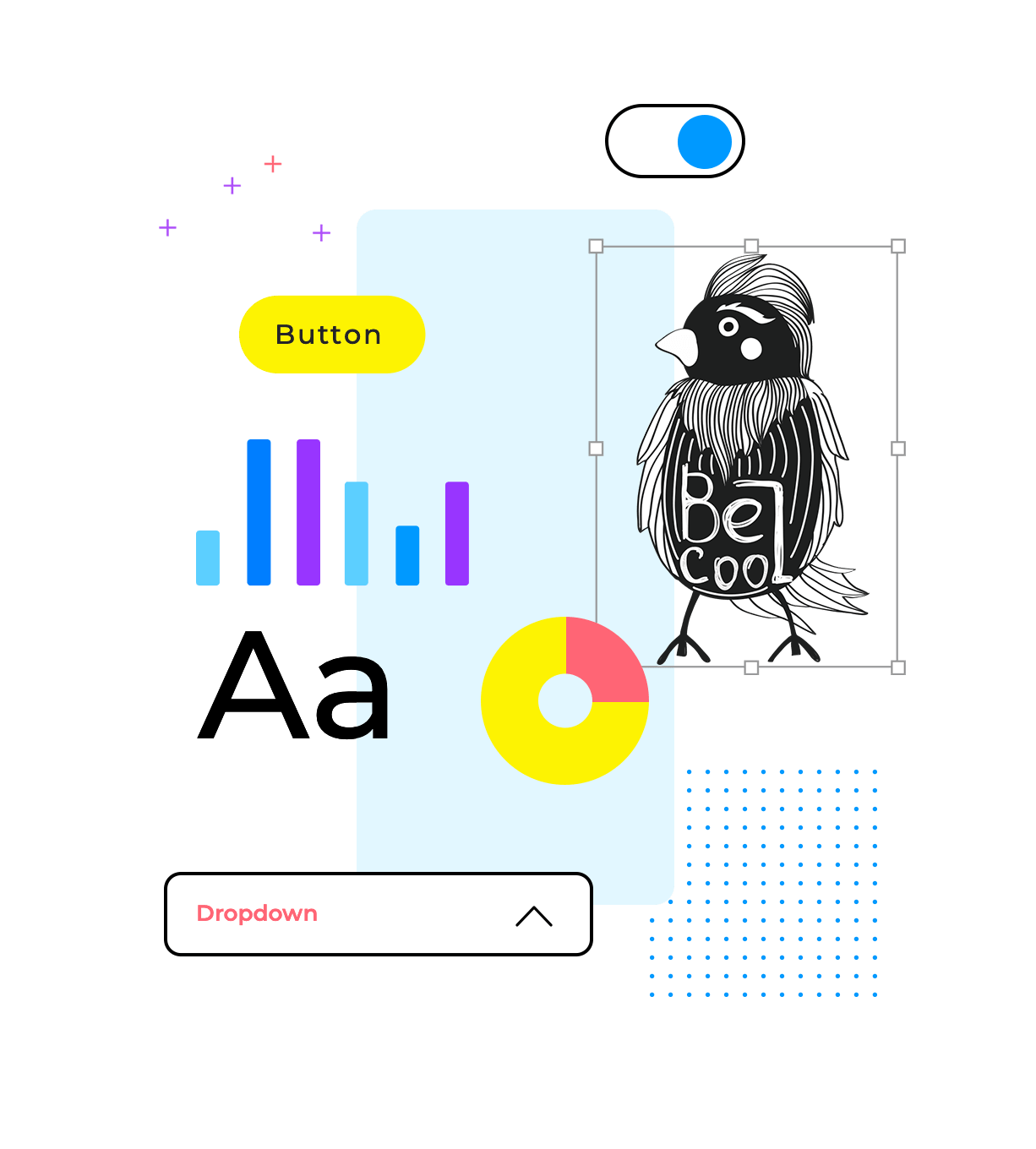

幸运飞行艇官网开奖查询 Free UI Design with no limits

Design your UI assets for free, without any restrictions on number of projects. Enjoy all UI design features, from the vector design tool, the pen tool, to pathfinders and more.

From low to high fidelity

With a single tool, you can cover the entire cycle of designing your products. Start by conceptualizing with low-fidelity wireframes, iterate, and validate your designs with high-fidelity prototypes and even interactive simulations.

Forms and data in motion

Design, prototype and simulate fully-functional forms and data grids-lists, and test them instantly without writing a single line of code.

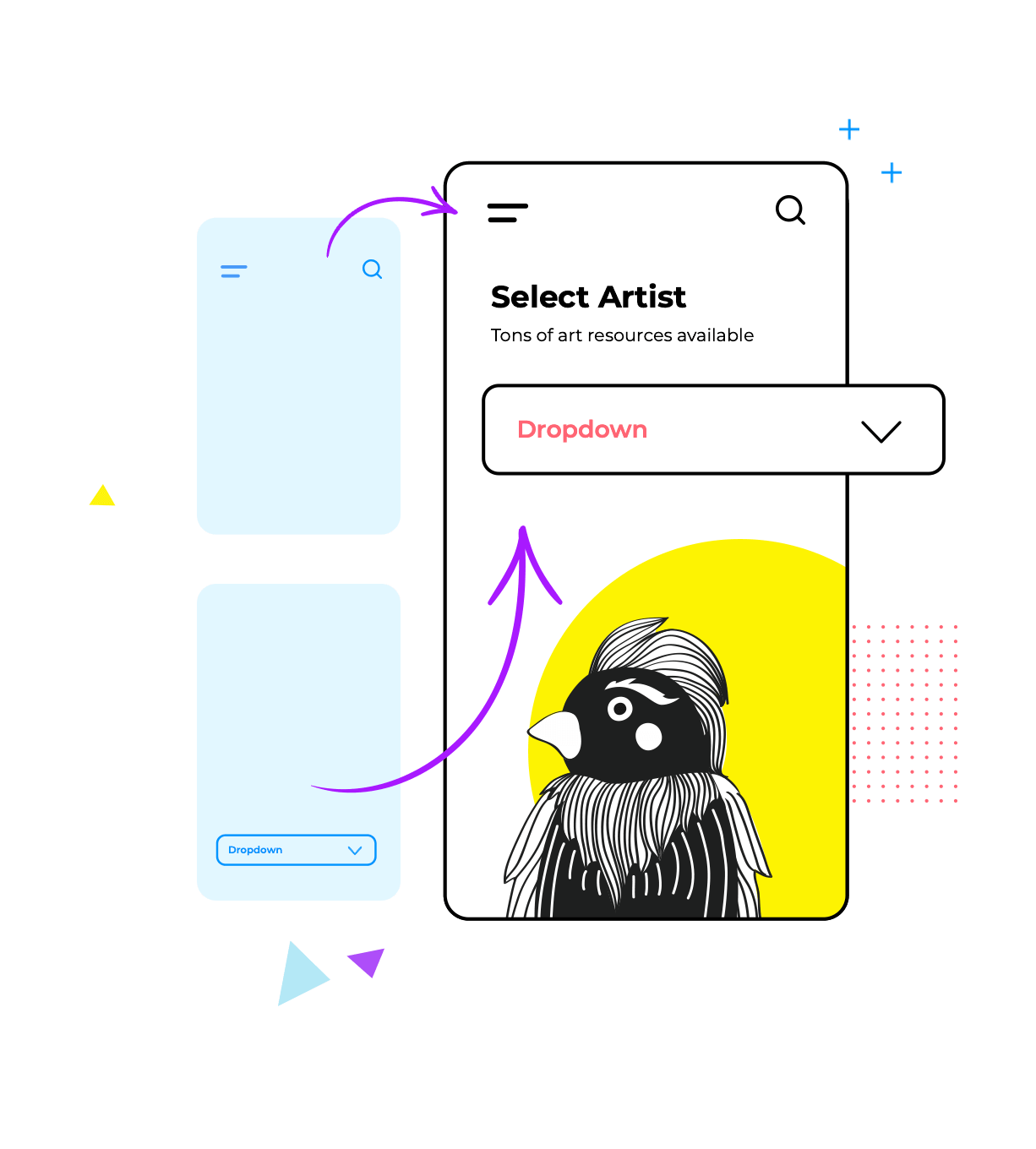

Bring your 幸运飞行艇官方开奖直播 prototypes to life in a click

Visualize your web and mobile prototypes, while you design them. Simulate prototype behavior while you design. Use our Emulator and Viewer App to test your prototype live on any iPhone, iPad or Android device.

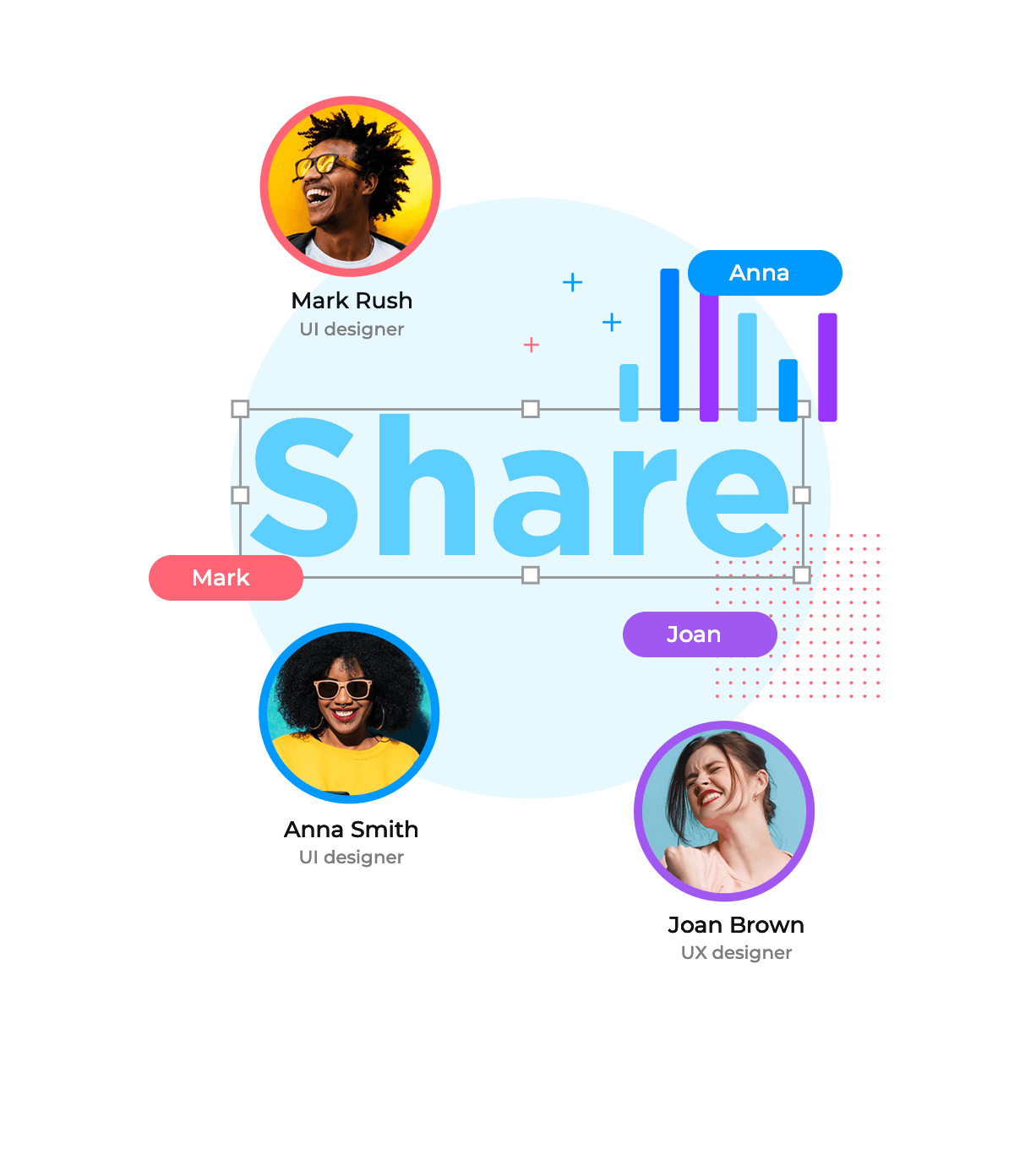

Design better experiences together

直播幸运飞行艇开奖官方查询官网-168幸运飞行艇开奖查询记录直播-飞艇168官方开奖记录现场. Validate early and often. Allow all your stakeholders to test and review your prototype, leaving no room for misunderstandings. Improve communication between teams, putting them all on the same page.

A single click lets you publish your prototypes and invite all project stakeholders to give feedback early on.

Multiple users can work on or edit the same prototype simultaneously. Our version control system tracks the changes.

幸运飞行艇168官方开奖记录查询-幸运飞行艇开奖官方结果查询官网-新168飞艇官网直播 Design Systems

Keep consistency in your Style Guides, UI component libraries, interactions, templates and other deliverables. Share your assets with design teams, business analysts and developers.

Easily refine and reuse the built-in libraries or create your own. Personalize them with your own style and interactions.

Centralized management for your UI kits. Maintain your UI elements and style guides synchronized across all your teams.

Templates and masters allow you to share and reuse content (headers, footers and more) across all the screens of a prototype.

幸运飞行艇官方开奖 Design and prototyping features you’ll love

Free design templates

Speed up your prototyping process with design resources and UI components pre-installed in our free prototyping tool.

Interactive UI components

Speed up your prototyping process with ready-made and frequently updated UI kits. You can also create your own UI kits with personalized components.

幸运飞行艇官方开奖记录查询-Integrations and plugins

By combining our design and prototyping strength and other design, project management and user testing tools, you’ll be able to create and test hi-fi prototypes.

Export to HTML and images

You can export your prototype to a fully functional and interactive HTML. Additionally, we provide an extensive set of features to export your assets to SVGs and PNGs.

Manage requirements

Add and manage text requirements within the UI prototype and integrate the requirements in your preferred Agile tool.

Export specification documents

With a single click, generate specifications documents from your prototypes. Create your own specifications document templates or use our API to generate the assets you need.

Success stories

幸运体彩飞行艇开奖官方开奖查询官网、历史记录查询-幸运飞行艇记录开奖查询-168飞艇最新开奖记录. Find out why thousands of users love to use Justinmind to create web and mobile app prototypes.

Temple University inspires the next generation of designers with Justinmind

Philadelphia’s Temple University bridges the gap between design and business with a little help from Justinmind

How middle schoolers are designing mobile apps with Justinmind

What happens when middle schoolers build prototypes with Justinmind? A whole heap of innovation

How TokBox solved rework problems with Justinmind

TokBox’s web and mobile app prototyping better since Interaction Designer Charles Diggs found the right prototyping tool

Recommended reading

168飞艇官网直播-幸运飞行艇168开奖官方开奖记录查询、幸运168飞行艇开奖结果查询网站. Learn more about the industry best practices, keep up with recent Justinmind updates and hear all about the latest trends of UX design.